A Beginner’s guide on how to do fundamental analysis on stocks: Fundamental analysis of a stock is used to determine the financial and business health of a company. It is always recommended to perform a complete fundamental analysis of the stock before investing if you are planning for a long-term investment.

If you’re involved in the market, you might also have about the term ‘Technical Analysis’. Well, technical analysis is a good approach to find the entry and exit time stock for intraday trading or short term. Here, we look into charts, trends, and patterns. You can make good profits using different technical indicators efficiently. However, if you want to find a multi-bagger stock to invest in, which can give you good returns year after year, then the fundamental analysis is the actual tool that you have to utilize.

This is because to get multiple times returns (say 5x or 10x), you need to remain invested in a stock for the long term. While the technical indicators will show you exit signs in the short term whenever there’s a downtrend or small setbacks, however, you have to remain invested in that stock if the company is fundamentally strong. In such cases, you have to be confident that the stock will grow and give good returns in the future and avoid short-term underperformance. Short-term market fluctuations, unavoidable factors, or mishappenings won’t affect the fundamentals of the strong company in the long term.

In this post, we are going to discuss how to do fundamental analysis on stocks (how to check fundamentals of a company). Here, we will elaborate on a few guidelines that if you follow with discipline, you can easily be able to select fundamentally strong companies.

How to do fundamental analysis on stocks?

Here are the six essential steps that you need to perform to analyze the fundamentals of a company in the Indian stock market. They are really simple, yet effective to find fundamentally healthy companies. Here it goes:

Step 1: Use the financial ratios for the Initial Screening

There are over 5,500 stocks listed on the Indian stock exchange. If you start reading the financials of all these companies (i.e. balance sheet, profit-loss statement, etc.), then it might take years. The annual reports of most companies are around 200-300 pages long. And it’s not worth your time to read each and every company’s report.

A better approach is first to shortlist a few good companies based on a few criteria. And then to study these screened companies one by one to pick the one that suits you the best.

Enroll for the ‘Fundamental Analysis For Beginners’ course in Hindi on FinGrad Academy.

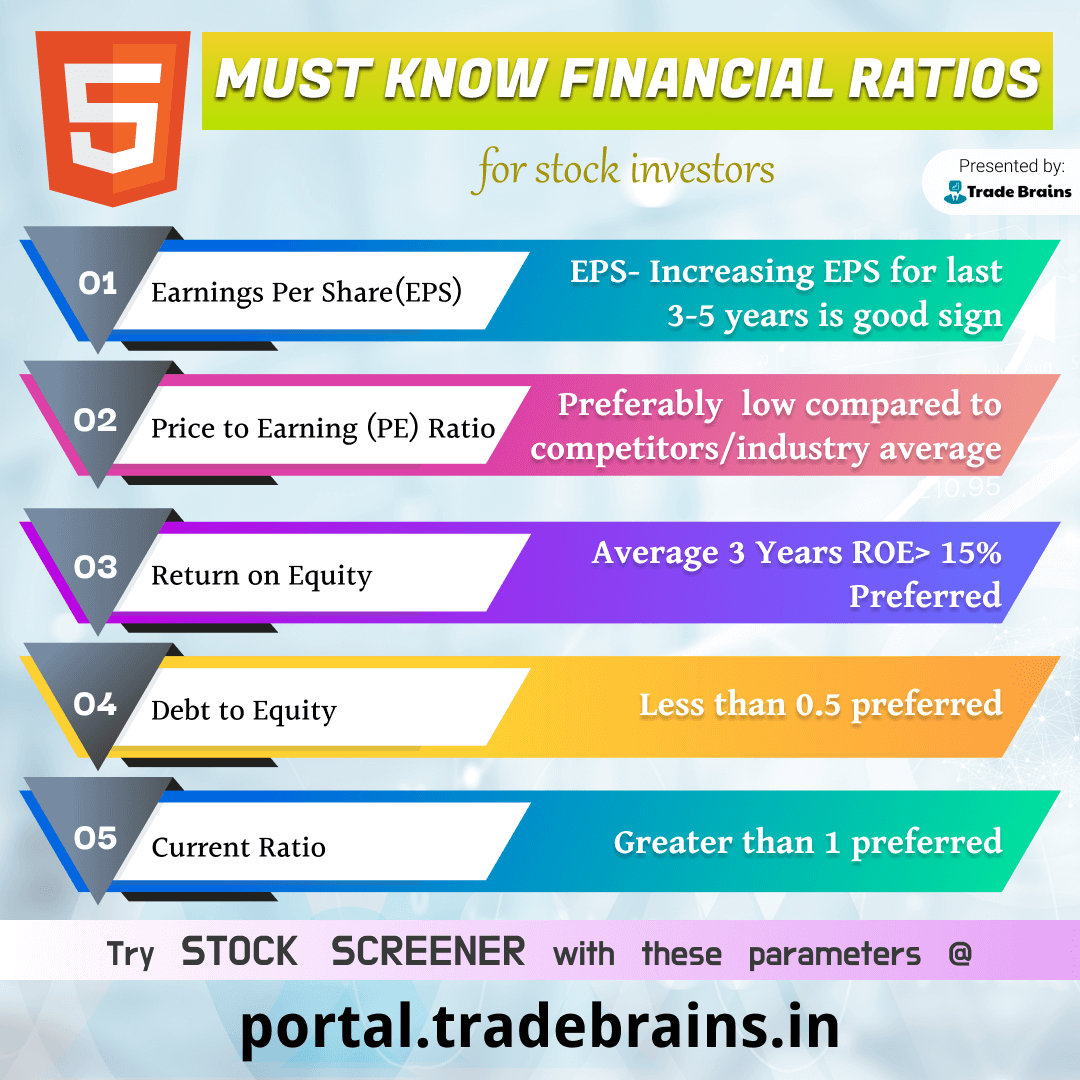

For the initial screening of the stocks, you can use various financial ratios like Price to Earnings (PE) ratio, Price to Book Value (PBV) ratio, ROE, CAGR, Current ratio, Dividend yield, etc. If you want to know more about the best financial ratios for screening, here’s an article on 8 Financial Ratio Analysis that Every Stock Investor Should Know. In short, you need to use different financial ratios for initial screening.

Next, for performing the stock screening using financial ratios, you can use Trade Brains Screener. Let me give you an example of how to screen stocks using Trade Brains Screener.

How to do a screening of stocks using Trade Brains Screener?

Step 1: Go to Trade Brains Portal.

Step 2: From the top menu, select Screener. Else, here’s the direct link.

Step 3: Add Criteria (financial ratios) to screen stocks

Step 4: Run the Filter to get the list of stocks

For example, if you want to filter companies with a PE ratio between 8 to 20 and dividend yield % between 1 to 3%, and Avg ROE for the last three years greater than 12%, you can select the following criteria. Trade Brains Screener will shortlist the stocks according to the criteria mentioned and give you the list of companies.

(Source: Trade Brains Portal)

Further, you can also add a number of financial ratios in your criteria like ROCE, Current Ratio, ROA, P/Book value, etc. Besides, you can also use any other financial ratio that you wish to screen stocks that suits your requirement.

Step 2: Understand the company

Once you’ve screened the companies based on the above criteria, the next step is to investigate them. It is important that you understand the company in which you are investing. Because if you don’t, you won’t be able to decide whether the company is performing good or bad, whether the company is making the right decisions towards its future goal or not; whether its competitors are doing good or bad compared to them and most importantly whether you should hold or sell the stock.

Therefore, it is essential that you understand the company. Questions like what are its products/services, who are leading the company (founders/promoters), management efficiency, competitors, etc should be known to you.

A simple way to understand the company is to visit its website. Go to the company’s website and check it’s ‘ABOUT’, ‘PRODUCTS’, ‘PROMOTERS/BOARD OF DIRECTORS’ page, etc. Read the mission and vision statement of that company. Further, if you can find the annual report of the company, download and read it. This report will give the in-depth knowledge of the company.

Further, if you are able to understand the products, services & vision of the company and find it attractive, then move further to the next step. Else, ignore that company.

ALSO READ

How to Select Shares to Buy in India? Stock Picking Guide for Beginners!

Step 3: Study the financial results of the company

Once you have understood the company and found it appealing, next you need to check the financials of the company like Balance sheet, Profit loss statements, and cash flow statements.

As a thumb rule, Revenue/Sales, net profit, and margin increasing for the last five years can be considered a healthy sign for the company. After that, you also need to check the other financials like Operating cost, expenses, assets, liabilities, etc.

Now, where can you find the financials of a company that you’re interested to invest? One of the best websites to check the financial statements of a company that I would definitely recommend you to check is Trade Brains Portal. Here are the steps to check the financial results of a company on the Trade Brains portal:

Step 1: Go to Trade Brains Portal

Step 2: Enter the company’s name in the search box. The company’s details will open like key ratios, profit and loss statement, balance sheet, cash flow statement, quarterly statements, peer competition, etc.

Step 3: Study the company’s financial results for the last five years.

(Fig: Reliance Industries Financials)

It is required that you study the financials of the company carefully in order to select a good stock for long-term investment. If you do not know how to read the financials of a company, you can check out this financial statement and ratio analysis course for beginners.

Step 4: Check the Debt and Red Flags

The total debt in a company is one of the biggest factors to check before investing in a stock. A company cannot perform well and reward its shareholders if it has a huge debt. They have to repay the debt and also pay interest on the borrowed money before anything else. In short, avoid companies with huge debts.

As a thumb rule, always invest in companies with a debt/equity ratio of less than one. You can use this ratio in the initial screening of stocks or else check it while reading the financials of a company.

In addition, also other red flags in the company can be continuously declining profit/ margin, low liquidity, and pledging of shares.

Step 5. Find the company’s competitors

It’s always good to study the peers of a company before investing. Determine what this company is doing that its competitors aren’t.

Further, you should be able to answer the question that why you are investing in this company and not any of its competitors. The answer should be convincing one like Unique selling point (USP), Competitive advantage, Low-cost products, Brand Value, future prospects (upcoming projects, new plant), etc.

You can find the list of the competitors of the company on the Trade Brains Portal itself. Just enter the stock name in the search box and navigate down. You will find a peer comparison there. Else, you can do a google search to find the competitors of the company. Study the competitors in detail before investing.

(Fig: Peers Comparison | Trade Brains Portal)

Step 6: Analyze future prospects

Most good investments are based on the future aspects/potential of the company and hardly on their current situation. Investors are interested in how much returns they can get from their investments in the future. Therefore, always invest in a company with strong long future prospects. Select only those companies to invest whose product or services will still be used twenty years from now.

Moreover, there is no point in investing in a CD or pen-drive making company with no long term (say 10 years from now) prospects. With cloud drives evolving so fast, these products will become obsolete with time.

If you are planning to invest for the long term, then the long life of the company’s product is a must criterion to check. Further, check future prospects, expansion possibilities, potential sources of revenue in the future, etc.

ALSO READ

What is Qualitative Analysis of Stocks? And How to Perform it?

Summary

Fundamental analysis is an old and proven method to find strong companies for long term investment. In this post, we discussed how to check the fundamentals of a company.

The six steps to perform fundamental analysis on stocks explained in this article are: 1) Use the financial ratios for initial screening, 2)Understand the company, 3) Study the financial reports of the company, 4) Check the debt and red signs, 5) Find the company’s competitors 6) Analyse the future prospects.

Also read: How To Invest Rs 10,000 In India for High Returns?

That’s all for today. I hope this post on ‘How to do fundamental analysis on stocks’ or ‘How to check fundamentals of a company‘ is useful to the readers. Further, If you find this post helpful and want me to write more contents on any similar topic, please comment below. Besides, if you’ve any doubts/queries, you can also ask in the comment section. I’ll be happy to help. Take care and Happy Investing.

Frequently Asked Questions (FAQs)

1. How do you study the fundamentals of a company?

To study the fundamentals of a company,

- Use financial ratios like the PE Ratio, PBV Ratio, Return on Equity, Compounded annual growth rate, current ratio, dividend yield and more to do the initial screening.

- Then, understand more about the company, the products and services that it offers, its future goals, its competitors, its management, its mission and vision.

- Check if its financial results are strong. Are the revenues and profits steadily increasing? What are its assets and liabilities, its operating cost, and more?

- Then check for red flags like declining profit, a debt-equity ratio greater than 1, low liquidity, and pledging of shares etc

- Study the competitors and understand why you are investing in this company and not its competitors.

- Analyse its future prospects and decide if it is really worth investing in the company.

2. What are the five steps of fundamental analysis?

The five steps for fundamental analysis are:

- Use financial ratios for screening

- Understand the company, its business, and future prospects.

- Study the financial reports of the company.

- Check for red flags.

- Compare the company with its competitors.

3. How do you analyse stocks for beginners?

There are two ways of analyzing stocks. One is fundamental analysis and the other is technical analysis. Fundamental analysis is generally used when you want to invest in a company for the long term. It involves a detailed study of the company, its competitors, its future prospects, and its financial reports. Technical analysis is done for intraday or short-term trading. It involves studying charts, trends, patterns and understanding how news can impact the share prices of companies.

4. How do you analyse stock before investing?

Here are a few tasks that should be on your checklist for analyzing stocks:

- Review its financial statements like Balance sheet, Income statement, Cash flow statement Notes to accounts, etc.

- Industry analysis: Study its competitors.

- Valuation: Find out if its valuation is fair and if it is worth investing in.

- Arrive at a price target to determine your entry and exit.

5. What are the 3 layers of fundamental analysis?

The three layers of financial analysis are Economic Analysis, Industry Analysis, and Company Analysis. These factors can be studied with a top-down or bottom-up approach while performing the fundamental analysis.

The post How to do Fundamental Analysis on Stocks? appeared first on Trade Brains.

Viahttps://ift.tt/NtmSUoI