Fundamental Analysis of Laxmi Organic Industries: After listing at a premium of 20% in March 2021, the stock of Laxmi Organic Industries rallied further by 200% in another 7 months. However, the stock has corrected 50% since then. Does this fall make it an attractive company? What can the investors of the company expect in the coming quarters? We’ll try to answer these and many other questions in our fundamental analysis of Laxmi Organic Industries Ltd.

Fundamental Analysis of Laxmi Organic Industries

We’ll start our study by getting ourselves familiar with the business and products of the company. Next, we’ll look at the market size and opportunities. After this, we’ll race through the financials of the stock. A highlight of the future plans and a summary conclude the article at the end.

Company Overview

Laxmi Organic Industries Ltd. was set up three decades ago by Vasudeo Goenka as a manufacturer of alcohol-based chemicals. It is presently led by his eldest son Ravi Goenka who serves as chairman and managing director of the company.

Over the years, the company has emerged as a leading manufacturer of acetyl intermediates (AI) in India. In addition to this, it also produces specialty intermediates (SI) such as ketene and diketene derivatives as part of its other segment. Lastly, fluoro specialty intermediates are the third division of the company.

As a feather in its cap, with a capacity of over 2,32,00 TPA, Laxmi Organic is one of the largest producers of Ethyl Acetate in India commanding a 33% market share. Furthermore, it also has domestic leadership in Diketene derivatives with a 55% market share.

Businesses from various industries including pharmaceuticals, inks & coatings, printing & packaging, agrochemicals, adhesives, dyes & pigments, electronic, automotive, and paints make use of the products of Laxmi Organic Industries.

Source: Laxmi Organic Industries Ltd. FY 2021-22 Annual Report

It owns three manufacturing facilities and two distilleries for Ethanol production which serves as a raw material for acetyl intermediates. Along with this, the chemical maker also has captive power generation capabilities.

Product-wise Segments

The high-value SI segment accounted for 35% of the top line and 65% of the profits in the nine-month period ending December 2022. While the balance was led by the AI division contributing to 65% and 35% of the sales and profits respectively.

Geography-wise Segments

It is one of the largest manufacturers of Ethyl Acetate worldwide with its products being exported to over 43 nations across 6 continents. Overseas sales accounted for 30% of the total sales in FY22.

We got a good understanding of the company and its products. Let us equip ourselves with the chemicals industry landscape for our fundamental analysis of Laxmi Organic Industries.

Industry Overview

Acetyl Intermediates (the key revenue segment of Laxmi Organic Industries) are commodity chemicals with wide usage applications. It is a large market will multiple small and large consumers and suppliers. The global commodity chemicals demand is pegged at $ 3,745 billion and is projected to increase at a rate of 5-6% over the next few years.

Talking about specialty chemicals, the worldwide market was valued at $ 847 billion in 2020 and is expected to grow at a CAGR of 5.2% to $ 1,090 billion by 2025. In recent years, India’s specialty chemicals industry boomed because of the Chinese-government decarbonization crackdown and the Covid-19 pandemic outbreak.

Source: Laxmi Organic Industries Ltd. FY 2021-22 Annual Report

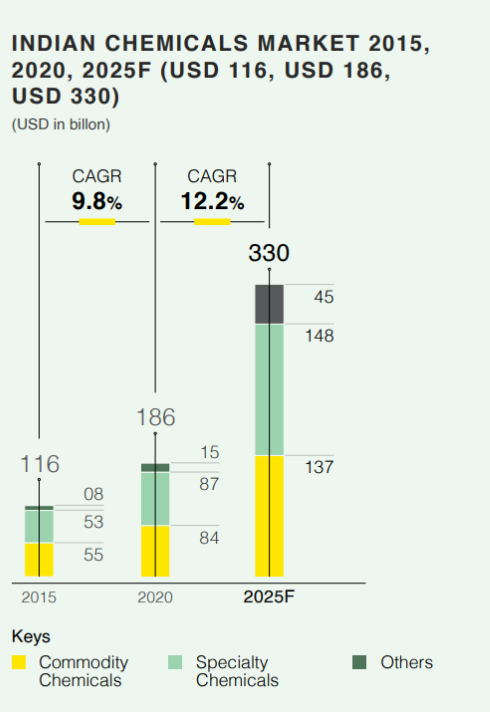

The structural shift is expected to benefit the nation immensely and increase its share in the global specialty chemicals industry to 6% by 2026 from 4%. Thus, India’s commodity chemicals industry is anticipated to touch $137 billion in value by 2025 while the specialty chemicals sector is expected to hit the $148 billion mark.

Source: Laxmi Organic Industries Ltd. FY 2021-22 Annual Report

Going forward, a variety of factors such as a slowdown in China, low-cost Indian producers, better research & development capabilities, and economies of scale will likely drive the growth of the chemicals sector in India.

Laxmi Organic Industries – Financials

Revenue and Net Profit Growth

We’ll now look at the financials of the company for our fundamental analysis of Laxmi Organic Industries.

The operating revenue grew at a CAGR of 17.23% from Rs 1,393 crore in FY18 to Rs 3,084 crore in FY22. During the same period, the profit after tax grew at a much sharper rate of 27.64% to Rs 256 crore.

The table below shows the operating revenue and net profit growth of Laxmi Organic Industries over the last few years.

| Fiscal Year | Operating Revenue | Net Profit |

| 2023 | TBA | TBA |

| 2022 | 3,084 | 256 |

| 2021 | 1,768 | 127 |

| 2020 | 1,534 | 70 |

| 2019 | 1,569 | 72 |

| 2018 | 1,393 | 76 |

| 5-Yr CAGR | 17.23% | 27.64% |

Profits can rise faster than sales either because of operating leverage or margin improvement. With Laxmi Organic, both factors played their respective roles. Let us understand this by performing a quick margin analysis.

Margin Analysis

From 2018-19, chemical companies started seeing volume and margin expansion because of the slowdown in China. That’s the first thing. Secondly, the share of the high-margin specialty chemicals division in the profits of Laxmi Organic increased in recent years.

Thus, both these events resulted in the widening of the operating profit margin and net profit margin of Laxmi Organic Industries. The table below showcases the improvement in margins of the chemical company over the last few years.

| Fiscal Year | Operating Profit Margin | Net Profit Margin |

| 2023 | TBA | TBA |

| 2022 | 9.34 | 7.66 |

| 2021 | 9.37 | 7.59 |

| 2020 | 4.21 | 4.58 |

| 2019 | 6.93 | 4.62 |

| 2018 | 8.62 | 5.43 |

Return Ratios: RoE and RoCE

Higher profitability directly aided return ratios: RoE and RoCE of the company. A casual observer may point out that FY22 return ratios are still below FY18. However, the data doesn’t present the complete picture.

Higher profits led to expansion in the equity base and reduction of debt. Furthermore, the company has been investing heavily in capacity expansion lately. The results of this CAPEX will accrue in the coming quarters. Thus, we can say that the return ratios of the company have considerably improved.

The table below presents the return on capital employed (RoCE) and return on equity (RoE) of Laxmi Organic Industries for the previous five fiscals.

| Fiscal Year | RoCE | RoE |

| 2023 | TBA | TBA |

| 2022 | 20.9 | 19.8 |

| 2021 | 13.6 | 16.5 |

| 2020 | 17.5 | 16.0 |

| 2019 | 20.7 | 17.5 |

| 2018 | 26.6 | 22.1 |

Debt / Equity Ratio

We’ll keep our debt analysis brief as Laxmi Organic Industries is a debt-free stock with an almost negligible debt-to-equity ratio of 0.07.

Future Plans Of Laxmi Organic Industries

So far we looked at previous years’ data for our fundamental analysis of Laxmi Organic Industries. In this section, we’ll try to understand what lies ahead for the company and its investors.

- Last year the company made a large capital expenditure of Rs 200 crore to increase the capacity of its specialty chemicals division. The management is bullish on this high-margin segment to continue to drive significant bottom-line growth.

- Recently, the company entered the Fluoro Speciality Intermediates market by acquiring a company’s assets in Italy. Next, it dismantled & relocated the plant to Maharashtra while setting up an R&D facility in Italy. This step will de-risk and diversify the company’s operations while aiding it to tap the innovative pharma, agro, and specialty chemicals markets.

- Furthermore, it has acquired a large floor space of 30,000 sq. ft. for setting up a new research and development facility.

Key Metrics

We are almost at the end of our fundamental analysis of Laxmi Organic Industries. Let us take a quick look at the key metrics of the stock.

| CMP | ₹270 | Market Cap (Cr.) | ₹7,200 |

| EPS | ₹5.96 | Stock P/E | 46 |

| RoCE | 20.9% | RoE | 19.8% |

| Promoter Holding | 72.5% | Book Value | ₹51 |

| Debt to Equity | 0.07 | Price to Book Value | 5.4 |

| Net Profit Margin | 7.7% | Operating Profit Margin | 9.3% |

In Conclusion

As we conclude our fundamental analysis of Laxmi Organic Industries, we can definitely say that the company has plenty of opportunities in the near future. However, to sustain its high P/E, the stock will have to deliver on sales growth consistently and maintain margins. Thus, chemical industry investors can keep a close watch on raw material prices and quarterly sales growth of Laxmi Organic.

In your opinion, what other factors should investors consider while investing in chemical companies? How about you let us know in the comments below?

By utilizing the stock screener, stock heatmap, portfolio backtesting, and stock compare tool on the Trade Brains portal, investors gain access to comprehensive tools that enable them to identify the best stocks also get updated with stock market news, and make well-informed investment decisions.

The post Fundamental Analysis of Laxmi Organic Industries – Future Plans & More appeared first on Trade Brains.

Viahttps://ift.tt/ML5aysQ