Fundamental Analysis of Polyplex Corporation: Investors look for diversification in their portfolios to hedge risk. This transcends to product lines, geography, and customers of the stocks. Polyplex is one such well-diversified stock with multiple products spanning various segments. It has a presence in 75 countries with manufacturing plants in 7 countries. Sounds so diverse, let us perform a fundamental analysis of Polyplex Corporation to know more about the company in detail.

Fundamental Analysis of Polyplex Corporation

In this article, we shall conduct a fundamental analysis of Polyplex Corporation. We will get ourselves acquainted with the history and business of the company, followed by the industry overview of the different product segments in which it operates. Later, a few sections are devoted to assessing revenue & profitability growth, return ratios, and debt analysis. A highlight of the future plans and a summary to conclude the article at the end.

Company Overview

Established in 1983, Polyplex Corporation is the seventh-largest manufacturer of polyester (PET) films globally. It is a leading producer of BOPET films and offers a broad portfolio of various substrates including BOPET (thin & thick), BOPP, CPP, and Blown PP/PE.

This specialty, innovative and differentiated products find their applications in packaging, electrical & electronic, and other industrial uses. The company has well-integrated backward and forward capabilities offering it cost competitiveness, supply security, higher innovation, value addition, and decreased earnings volatility.

Polyplex has a global presence in 75 countries with manufacturing and distribution facilities across the USA, Indonesia, India, Thailand, and Turkey. As for domestic sales, India contributed 19% of the revenues in the recent fiscal year. Overall, the company is well diversified in terms of region-wise sales.

Its downstream businesses that produce digital media films, laser printer films, lamination films and more such diverse products made up 16% of the revenues in FY22. This segment assists in stabilizing overall margins for many products.

The table below shows the breakdown of sales of Polyplex Corporation across various heads:

We read about the business of Polyplex with a focus on diversity as per various segments. Now, let us move ahead to understand the polyester (PET) films industry and its growth prospects.

Industry Overview

For our industry analysis, we’ll restrict our coverage to the product segments in which the company primarily operates: Thin PET, Thick PET, and BOPP. Together these three segments accounted for 71% of the income.

The global BOPET films market is divided into thin films and thick films.

Thin BOPET Films

Thin films make up over 3/4th of PET film demand worldwide. Flexible packaging is the largest sub-segment of thin films, accounting for 75% of the total thin films used.

As for consumption, Asia is the largest market for thin polyester films. The continent consumes more than 3/4th of the total thin films produced worldwide. Globally, the market is projected to grow at 5-6% for the next few years. Domestic market growth is expected at about 10% every year.

In the years ahead, an increase in purchasing power and a concurrent rise in per capita packaging material consumption will primarily lead to thin BOPET film demand growth.

Thick BOPET Film Market

Electronics, electrical & other industrial products make up for the demand for thick BOPET films. The global thick film market is projected to grow at a consistent CAGR of 4-5% in the coming years.

A rise in photovoltaic, flat panel displays, liners for electronic applications, and flexible electronics are expected to be major growth catalysts.

BOPP Film Market

BOPP is similar to BOPET but has added properties of high moisture resistance, sealing, etc. The global BOPP market is estimated to grow at 4% every year. Domestic market growth is expected at about 15% every year.

As for the two major segments, food packaging made up 64% of the total BOPP demand, followed by 18% of non-food packaging applications.

Putting all this together, we can say that the BOPET and BOPP demand in India (and other developing countries as well) is projected to grow faster than the global average. In the next section of our Polyplex Corporation, let us take a look at how the company has grown over the years.

Polyplex Corporation – Financials

Revenue & Net Profit Growth

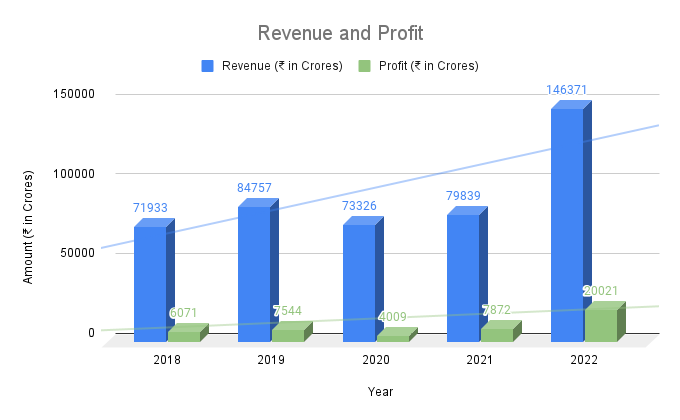

The operating revenue of the BOPET manufacturer has grown at a CAGR of 13.05% every year from Rs 3,588 crore in FY18 to Rs 6,624 crore in FY22. During the same period, its net profit advanced at a much sharper rate of 27.70% compounded annually to Rs 965 crore in FY22.

The table below presents the operating revenue and net profit figures of Polyplex Corporation for the last five financial years.

| Financial Year | Operating Revenue (Rs Cr) | Net Profit (Rs Cr) |

| 2022 | 6,624 | 965 |

| 2021 | 4,918 | 862 |

| 2020 | 4,487 | 494 |

| 2019 | 4,570 | 584 |

| 2018 | 3,588 | 284 |

| 5-Yr CAGR (%) | 13.05% | 27.70% |

We noted above how the bottom line of the company tripled in the past few years. What can be the reason behind the same? Read the next section on profit margins to find out.

Margins: Operating Profit & Net Profit

Polyplex reported an operating profit margin and net profit margin of 17.57% and 14.56% in FY22 respectively. The margins were lower than those clocked a year before but still high enough.

Overall, the operating profit margin of the company has expanded significantly in FY22 when compared with FY18 levels. This has resulted in higher profitability and a wider net profit margin.

The data below shows the improvement in the operating margin and net profit margin of Polyplex Corporation over the last five fiscals.

| Financial Year | OPM (%) | NPM (%) |

| 2022 | 17.56 | 14.56 |

| 2021 | 20.25 | 17.52 |

| 2020 | 13.12 | 11.00 |

| 2019 | 15.00 | 12.77 |

| 2018 | 9.89 | 7.95 |

Summing up the findings of our fundamental analysis of Polyplex Corporation so far, we can say that the operating income of the company has grown impressively. But more than that, it has gained on broader margins as the demanding industry improved.

In the next section, we take a look at the effect of higher profit margins on the return ratios of the business.

Return Ratios: RoE & RoCE

Following the suit of profit margins, the return ratios: the return on equity (RoE), and the return on capital employed (RoCE) have gotten better in the last five years.

In FY 2021-22, RoE and RoCE of Polyplex Corp. stood at the top of 30.30% and 29.08% respectively. This points to the strong profitability of the BOPET business overall and the pricing power of the company.

The information below highlights the RoE and RoE for the previous five years of the company.

| Financial Year | RoE (%) | RoCE (%) |

| 2022 | 30.30 | 29.08 |

| 2021 | 28.35 | 26.45 |

| 2020 | 17.03 | 17.92 |

| 2019 | 21.95 | 19.68 |

| 2018 | 11.72 | 10.83 |

From the figures above, we can take into note one more thing. There is not much disparity between the two return ratios across different fiscals in the past. Perhaps, the debt is low and the management has not resorted to financial leverage to inflate the return on equity.

Time to find out in the next section of our fundamental analysis of Polyplex Corporation.

Debt to Equity & Interest Service Coverage

The table below shows lists the debt-to-equity ratio (D/E) and interest service coverage ratio (ISCR) of Polyplex Corporation for the last five years.

| Financial Year | Debt/Equity | Interest Service Coverage |

| 2022 | 0.28 | 70.49 |

| 2021 | 0.23 | 56.67 |

| 2020 | 0.25 | 36.53 |

| 2019 | 0.28 | 23.58 |

| 2018 | 0.34 | 8.96 |

We can easily see that the stock carries very low debt at a D/E ratio of 0.28 only. In addition to this, its ISCR has surged multi-fold as the bottom line of the company has grown over the years.

Basically, Polyplex Corporation is a financially strong company.

Future Plans Of Polyplex Corporation

So far we have only looked at the previous fiscals’ results for our fundamental analysis of Polyplex Corporation. In this section, let us see what lies ahead for the company and its investors.

- The company is currently increasing its manufacturing capacity of polyester films in the US. After its completion, it will be the second-largest producer of BOPET globally excluding China.

- Polyplex has 27 patents across various products, processes, & nations and has filed applications for 14 more patents.

Fundamental Analysis of Polyplex Corporation – Key Metrics

We are now almost at the end of our fundamental analysis of Polyplex Corporation. Let us take a quick look at the key metrics of the stock.

| CMP | ₹1,749 | Market Cap (Cr.) | ₹5,500 |

| EPS | ₹211.00 | Stock P/E | 8.32 |

| ROCE | 29.08% | ROE | 30.30% |

| Face Value | ₹10.0 | Book Value | ₹1,131 |

| Promoter Holding | 51.0% | Price to Book Value | 1.53 |

| Debt to Equity | 0.28 | Dividend Yield | 5.91% |

| Net Profit Margin | 14.56% | Operating Profit Margin | 17.56% |

In Conclusion

We noted above how the industry growth and integrated business model have assisted the company to clock higher topline and bottom-line figures. In the last year, the stock has become a new favorite of FIIs as their shareholding has increased to 14.81% from 8.64% only for the quarter ending September 2021.

In your opinion, what lies ahead for the Polyplex group? At present P/E of 8.32, is it an attractive bet? Will the company be able to sustain its margins? How about we continue this conversation in the comments below?

You can now get the latest updates in the stock market on Trade Brains News and you can also use our Trade Brains Stock Screener to find the best stocks.

The post Fundamental Analysis of Polyplex Corporation – Financials, Future Plans & More appeared first on Trade Brains.

Viahttps://ift.tt/9T8QE2C