Fundamental Analysis of Dixon Technologies: Have you heard about Foxconn, a company that manufactures iPhones for Apple since 2007? Well, it is a contract manufacturer. Based in China, it is one of the largest smartphone makers in the world.

Contract manufacturing is a booming industry. Many companies like Apple have the resources to manufacture their own phones or gadgets. But they ask or give contracts to other companies to do so. Why? You might ask. Well, outsourcing this function helps them to focus on their strength.

In this case, contract manufacturing helps Apple focus on innovation and customer experience, while manufacturing is delegated to Foxconn.

In this article, we shall take a look at a similar Indian company. After a sixfold jump in two-and-a-half years, it has got a lofty valuation! We shall do a fundamental analysis of Dixon Technologies, the brand behind the brands. We’ll take a look at its business, its clients, its financials, and more. Let’s begin, shall we?

Fundamental Analysis of Dixon Technologies – Overview

About the Company

Dixon Technologies is a contract manufacturer. The company has been leading the electronic manufacturing services (EMS) space in India for years. It provides manufacturing and design-focused solutions in consumer durables, home appliances, lighting, mobile phones, security devices, set-top boxes, wearables, and medical equipment.

In addition, it provides repair and refurbishment services for LED TV panels.

Industry Overview

India’s factory-to-the-world ambitions are being bolstered as China is threatening to retreat from the West. The reason for optimism is ingrained in geopolitics. Multinational firms need a backup location for making gadgets. Well, India has got quite a deep labor pool, which may work in favor of a China +1 strategy.

The total addressable EMS market in India was valued at ₹ 2,654 billion (USD 36 Billion) in FY21 and is expected to grow to ₹ 9,963 Billion (USD 135 Billion) in FY26 with a CAGR of 30%. However, the contribution of Indian EMS companies is around 40%, which is valued at ₹ 1,069 Billion (USD 14 Billion) in FY21, which is expected to grow at 41% CAGR to reach $ 5,978 Billion (USD 81 Billion) by FY26.

Fundamental Analysis of Dixon Technologies – Business Overview

So far in the article on Fundamental Analysis of Dixon Technologies, we took a look at what Dixon Technologies does and the industry overview. We shall now take a look at its clientele, manufacturing facilities, and business divisions.

Clientele

Leading global and domestic brands form the clientele of this home-grown company. It is the biggest manufacturer of LED TVs in India for clients like Samsung, Panasonic, Xiaomi, TCL, OnePlus, and more. Further, it produces lighting products for companies including Philips, Havells, Syska, Bajaj, Wipro, and Orient.

Moreover, it manufactures semi-automatic washing machines for Godrej, Samsung, Lloyd, and Panasonic.

Manufacturing and R&D Facilities

Dixon Technologies has 18 state-of-the-art manufacturing facilities located in Uttar Pradesh, Uttarakhand, and Andhra Pradesh. These have been accredited with ISO 9001-2015, ISO 14001-2015, and 45001:2018 Quality certificated.

In addition, Dixon Technologies is eligible for Indian government subsidies under five different production-linked incentive programs. Further, they have 6 research and development (R&D) centers in India and China.

PLI Scheme

Dixon is a proud recipient of approval under 5 PLI schemes i.e. lighting, mobile, IT hardware, air conditioners, wearables, and wearables. Further, it has a budget of roughly ₹ 409 billion, under Mobile Manufacturing and Specified Electronic Components, which is much more than any other scheme.

The PLI Scheme presents a financial incentive to stimulate domestic production and attract big value-chain investments. This plan encourages businesses to make use of existing installed capacity to meet rising home demand.

Business Verticals

Founded in 1993, Dixon has now expanded its operations to various sub-segments of electronics. It serves as an original equipment manufacturer (OEM) as well as an original design manufacturer (ODM).

Dixon simply executes what its clients ask it to under the OEM model. OEMs source components and materials to assemble the final product based on the client’s specifications. Clients decide how the final product will look and function. Dixon makes most of its money by being an OEM.

As an ODM, Dixon Technologies can exhibit its creativity. ODMs develop ideas, design the product from scratch and choose raw materials. In fact, they can alter the technical specifications as well. This model helps them, or any other ODMs to earn better margins.

Mobile Phones

Dixon Technologies is one of the fastest-growing mobile phone manufacturers in India. They are setting up in-house capabilities to manufacture key components including sheet metal, plastic parts, batteries, and adaptors.

Security Surveillance system

This division is a joint venture between Dixon and Aditya Infotech Limited. They manufacture security devices under the brand name AIL Dixon Technologies Private Limited (“ADTPL”). They deliver quality products with minimum lead time.

Reverse Logistics

Within a period of two years, it established a PAN India leadership. It is amongst the few companies to have a panel repairing facility in India. This segment trains professional. Moreover, it offers services for the repair and refurbishment of multiple products like set-top boxes, LED TVs, mobile phones, CCTVs, Modems, and Computer Peripherals.

Medical Electronics

Dixon Technologies forayed into the manufacturing of diagnostic testing machines in 2020. have signed an MOU with Molbio for manufacturing Truelab™ Quattro Real Time Quantitative micro PCR Analyzer machines. These machines can conduct 190-200 tests per day, for infectious diseases including Covid-19.

Set-Top Boxes

The company manufactures set-top boxes for leading DTH players. It sees robust growth opportunities in this segment.

Consumer Electronics

They provide ideal, innovative, and tailor-made consumer electronics. These are top-notch, defect-free, and cost-efficient and suit the modern taste and preferences of our customers across the globe.

Home Appliances

Dixon Technologies has in-house facilities to create solutions that have modern and new features including a magic filter, waterfall, side scrubber, and air dry. They design, manufacture, and test a wide range of washing machines. The revenue from this segment is completely based on the ODM model.

Lighting Solutions

They design and manufacture LED lighting solutions ranging from 0.5W to 100W. This includes main electronic board designing, mechanical, light source & packaging design. In fact, they have in-house capabilities to manufacture key inputs such as sheet metal, plastic molding, and wound components. This has enabled them to emerge as an ODM player in India.

Competitors & Moat

Some of the major competitors of Dixon Technologies are Honeywell Automation, CWD, Mirc Electronics, and Wonder Fibromats. Here are a few factors that give a competitive advantage to Dixon Technologies:

- End-to-end solutions and a backward integrated campus.

- Approval under 5 PLI schemes

- Diversified product portfolio

- A wide array of domestic and global customers

- In-house Moulding facility

- Full cleanroom technology

- High-speed SMT lines

Dixon Technologies – Financials

Revenue and Profitability

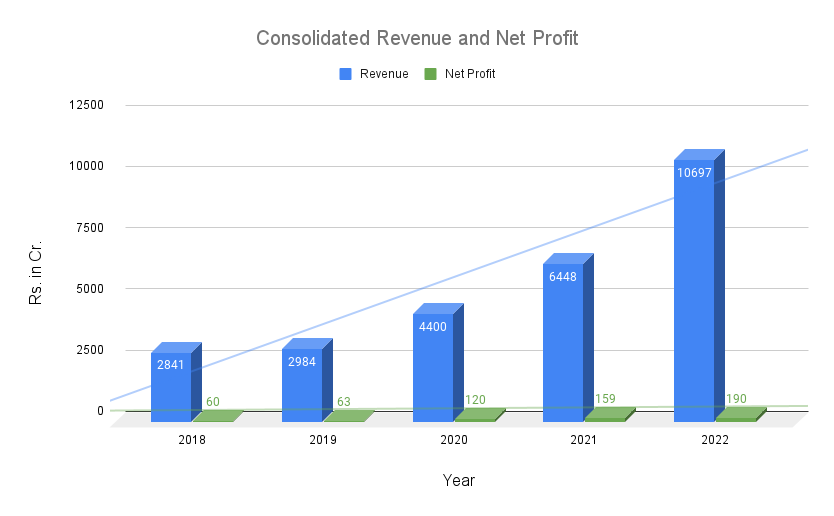

| Year | Revenue (₹ in Cr) | Net Profit (₹ in Cr) |

|---|---|---|

| 2018 | 2841 | 60 |

| 2019 | 2984 | 63 |

| 2020 | 4400 | 120 |

| 2021 | 6448 | 159 |

| 2022 | 10697 | 190 |

The revenue, as well as the net profit of Dixon Technologies, shows an increasing trend. This holds good for the consolidated as well as standalone numbers. The company has a 3-year CAGR sales growth of 89.32% and a 3-year CAGR net profit growth of 73.35%, indicating that they grew well.

The company’s performance in the September quarter (Q2FY23) was better than estimated. Mobile and home appliances segments pushed the sales growth higher. Analysts say that long-term margin expansion would be led by backward integration and an increasing share of ODM revenues.

Profit Margin

| Year | Operating Margin (%) | Net Profit Margin (%) |

|---|---|---|

| Mar 2018 | 4.29 | 2.57 |

| Mar 2019 | 4.29 | 2.23 |

| Mar 2020 | 4.83 | 3.01 |

| Mar 2021 | 4.08 | 2.67 |

| Mar 2022 | 3.08 | 2.01 |

Dixon Technologies has poor profit margins in FY22. In fact, they have decreased because of an inflationary environment that led to an escalation in the cost of raw materials.

Debt & Return Ratios

| Year | RoE (%) | RoCE (%) | ROA (%) |

|---|---|---|---|

| Mar 2018 | 19.33 | 30.54 | 6.30 |

| Mar 2019 | 16.75 | 21.09 | 4.24 |

| Mar 2020 | 22.25 | 28.90 | 7.09 |

| Mar 2021 | 21.67 | 25.07 | 5.61 |

| Mar 2022 | 19.07 | 19.39 | 4.44 |

The company’s debt has increased over a period of five years. However, it has an ideal debt-to-equity ratio of 0.46. The company has an ideal return on equity. However, its return on capital employed and return on assets fell short of the ideal requirement.

Shareholding

The promoters hold a 34.27% stake in the company. FIIs hold 16.27%, DIIs hold 18.59% while the public holds a 30.87% stake in the company. There is no pledge against the promoter’s shareholding, which is a good sign.

A few notable DIIs that hold a stake in the company are Life Insurance Corporation of India (5.75%), ICICI Prudential Life Insurance Company (2.36%), NipponLife India Trustee Ltd- A/C Nippon India RET (1.88%), DSP Equity and Bond Fund (1.01%).

Key Metrics

| Particulars | Values | Particulars | Values |

|---|---|---|---|

| Face Value (₹) | 2 | ROE (%) | 19.07 |

| Market Cap (Cr) | 26,903 | Net Profit Margin | 1.77 |

| EPS (₹) | 39.15 | Current Ratio | 1.15 |

| Stock P/E (TTM) | 115.8 | Debt to Equity | 0.46 |

| Dividend Yield (%) | 0.04 | Promoter’s Holdings (%) | 34.27 |

In Closing

In this article, we took a look at a Fundamental Analysis of Dixon Technologies. We went through the industry that it functions in, its business overview, and its moat. Then we took a look at its financials like revenue, profitability, ratios, and shareholding. That’s all for this article folks. We hope to see you around. Happy investing until next time!

The post Fundamental Analysis of Dixon Technologies – Financials, MOAT & More appeared first on Trade Brains.

Viahttps://ift.tt/ZDaivMK